by Tim Massie, CFP®

Owner of Timepiece Financial Planning, Inc.

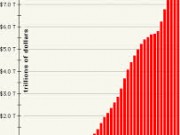

I have a hard time visualizing trillions of dollars. I still remember as a child my mother counting out a few hundred dollars for a purchase, and just staring at the bills! By mowing the lawn I could earn $4 and it took me a long time to come up with anything close to $100. A million dollars is still a lot of money to most of us. A million dollars is a thousand dollars…one thousand times. Some people are millionaires many times over… Billionaires! To have a billion dollars, you need a million dollars….one thousand times. This already sounds ridiculous but next comes Trillions! All you need to be a Trillionaire is a million dollars…..one million times.

In 2012, the federal budget deficit was about $1.1 trillion dollars. That means they spent that much more than it took in in taxes. We have debts of about $16 Trillion currently, but only if you use funny accounting. By including the very real liabilities of Social Security, Medicare, and federal employees’ future retirement benefits that have been promised (but not reflected in the reported 16 trillion number) our national debt according to Chris Cox and Bill Archer writing in the Wall Street Journal, is about $87 Trillion dollars.

My point isn’t to frighten you with these numbers. I think we are all nervous enough without any more help. The point is determining- What does it mean for us? After all, the point of financial planning is to be prepared. Obviously everyone’s situation is different, but perhaps a few general observations are in order.

- All notions that the government is going to “take care of us” should be re-examined.

- Healthcare is a big underfunded liability, so don’t underestimate your personal healthcare budget going forward. More of it will likely fall back on you

- If you have a career you enjoy, don’t be too quick to retire.

- Live beneath your means so you have a shot at accumulating wealth of your own.

- Do your best, and leave it at that!

If you are still worried I heartily recommend reading “How to stop worrying, and start living” by Dale Carnegie. Published first in 1944, it’s still timeless, helpful advice.